Determining financial aid is based on a family’s “need.” Need is determined by looking at a family’s income and assets (and, in some financial aid applications, expenses like medical bills). Families often think of real estate as an asset, but real estate can take different forms–the primary residence, a second home or investment, or a business property. Let’s look at when and how real estate factors into financial aid calculation.

A family’s primary residence or a family farm that is the primary residence is not included as an asset on the FAFSA or Free Application for Federal Student Aid. The FAFSA is used to determine federal financial aid, including grants, loans, and work-study.

Some colleges use an institutional method to determine financial need awarded by that school, and they use the College Board’s CSS Profile application. On the CSS Profile, families are asked to provide details to determine the home equity value of their primary residence. These colleges want a more complete picture of a family’s financial status.

Not all CSS Profile universities handle home equity in the same way. Some ignore it. Some cap the home equity value at double the family’s income. Others don’t cap the amount. If a college calculates home equity, 5% is added to the Expected Family Contribution or EFC. For example, if the family’s home equity were $400,000, a college that doesn’t cap the amount would add $20,000 to the EFC. If that same family had an income of $100,000 and the college capped the home equity value at double the family’s income, then the amount would be $200,000 times 5% or $10,000 added to the EFC.

Some think owning a second home and renting it out for part of the year qualifies it as a small business. Unfortunately, a rental property typically does not qualify as a small business under the FAFSA. (Family-controlled small business assets are excluded from the FAFSA.) The property would need to be a more formally recognized business, like a motel that provides regular maid service.

The rental property’s net worth is reported as an asset on the FAFSA. Note: we said “net worth” not “market value.” To obtain the net worth, subtract the property’s value minus its outstanding debt. If the debt exceeds the value, report a zero (not a negative number). If more than one property is owned and one has a negative net worth, do not subtract that value from the net worth of the other properties. It is still treated as a net worth equal to zero.

Family-owned small business (less than 100 employees with 50%+ ownership) assets are excluded from the FAFSA. In most cases, rental properties are not considered a small business.

If you own a business with 100+ employees, you need to estimate the value of the business (minus any outstanding debts and adding in any physical assets) to report it on the FAFSA.

In the future, even small business owners under 100 employees will need to report their business’s value. However, if your income is under $59,999, no assets, including a business, will need to be reported.

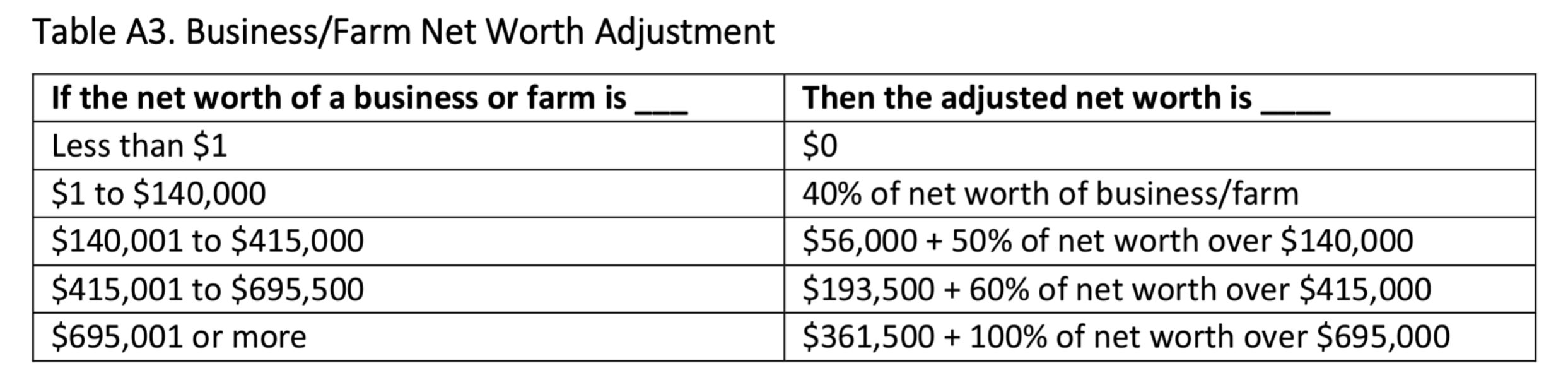

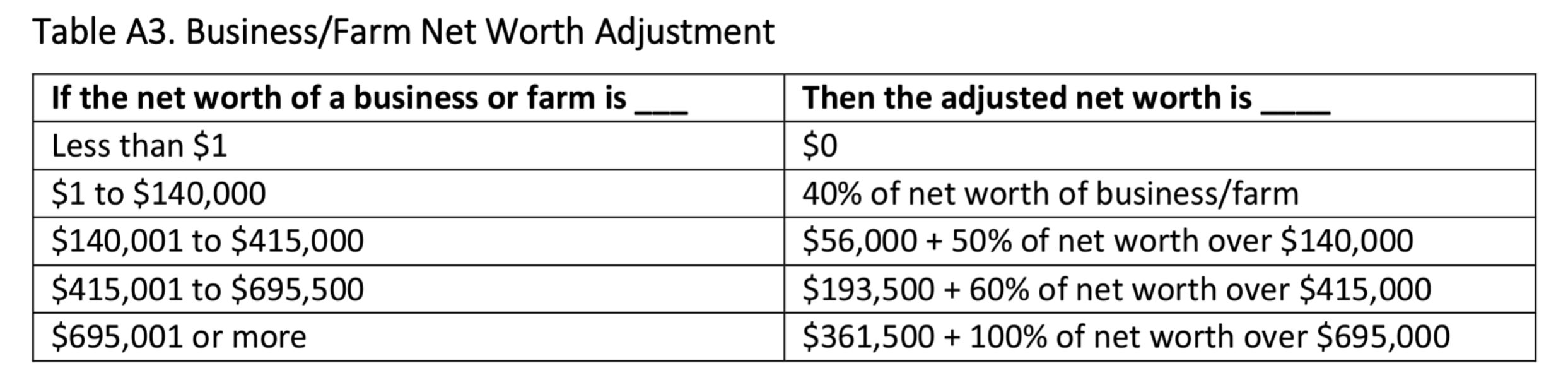

In fact, the way your family farm or business’s value is calculated on a sliding scale:

Are you wondering if your rental property or business-owned real estate counts as a business asset? “If the deed or title to the real estate is held by the business, as opposed to the taxpayer, it should be reported as a business asset. But if the business merely manages the real estate without owning the real estate, the real estate is not a business asset.”

If a rental property is reported on Schedule C of the IRS 1040 form, it PROBABLY is a business asset and can be excluded from the FAFSA. However, colleges will still want to ensure it qualifies as a business. The taxpayer must provide “significant services” like regular cleaning, etc. Significant services do not include providing and paying for utilities. If a property is reported on a Schedule E, it is an investment to include in the FAFSA.

The CSS Profile does not have an exclusion for small business assets. Everything is reported.

When creating a college list, consider what kind of financial aid application you must complete and how your family’s situation will impact the determination of need.

Updated September 2023

Joe is a leading authority on late-stage college funding. He frequently speaks to organizations and parent groups such as BMI Credit Union, Westerville City Schools, At the Core, CollegeWire, and I Know I Can, among others. He is also a highly regarded thought leader in the financial planning community. He is frequently asked to speak at industry conferences about his College Pre-Approval™ process providing Continued Education for CPA’s and CFP® through through the FPA, XYPN, and OSCPA and has been published in the Journal for Financial Planning.