Nicole Bachaud • Feb 24 2023

The pandemic acted as a catalyst for change in the housing market, often heightening the disparities between the haves and the have nots. But there were some moments of progress towards more equal housing opportunities, one being the shrinking racial home value gap. Despite disparate impacts of job loss and financial strain during the pandemic threatening to undo progress that had been made over the past decade, Black home values increased faster than home values overall, a major boost for Black household wealth.

To estimate the typical home value by race, Zillow analyzed the demographic makeup of homeowners in ZIP codes across the country, then looked at the typical home value in each ZIP code over time. Weights were assigned based on the share of households headed by various races in each ZIP code, then those home values were aggregated across the country into the final estimates of home value by race.

The home value gap between races is wide, but it had been shrinking prior to the pandemic. Black home value increases have outpaced all other races since 2014, when the housing market really started to recover from the Great Recession. This progress continued during the pandemic. Black home values appreciated 42.5% from pre-pandemic to January 2023, compared to 38.2% for overall home values and 37.8% for white home values.

That amounts to an increase of nearly $84,000 in equity for the typical Black homeowner over this period, substantially increasing wealth for Black homeowners — a primary residence accounts for over two thirds of Black homeowners’ household wealth . With the typical Black mortgage owner putting 3.5% down — $6,900 on the typical Black home purchased in February 2020 — that return on investment is a massive 1,114%, as of January 2023.

Black homeowners not only saw large increases in their equity over the pandemic, they saw the highest appreciation in home values out of all race groups. At the height of the housing market frenzy in the summer of 2021, Black home values reached 21.1% annual appreciation vs 19.1% for home values overall. The accelerated home value growth for Black-owned homes helped to improve the ratio of Black home values to home values overall. In February 2020, the typical Black home was worth 82.7% of the value of the typical home overall. By January 2023, that ratio increased to 85.2%. This is still a large gap, but it’s the closest Black home values have been to overall values since at least 2000.

Some markets saw extraordinary growth in Black home values over the pandemic. In Detroit, a market that has struggled with the lasting effects of redlining and thus is no stranger to housing inequalities, Black home values have increased 51.7% and the ratio of Black home values to home values overall has moved up nine percentage points since February 2020. Other markets in the Midwest, such as Kansas City, Chicago, Cleveland, Milwaukee and Louisville, also saw large improvements over this period to the Black home value ratio – all seeing the ratio increase at least five percentage points.

The West Coast didn’t see the same progress. Markets that have historically had a smaller share of Black residents and more expensive home values saw the gap between Black home values and home values overall widen since the start of the pandemic. San Francisco, a metro area where only around 8% of the population is Black, saw the ratio of Black home values to home values overall drop 3.6 percentage points since February 2020. Most of the markets with a decrease in this ratio are places where homes are expensive and the pandemic price increases had the largest effect on affordability across the board.

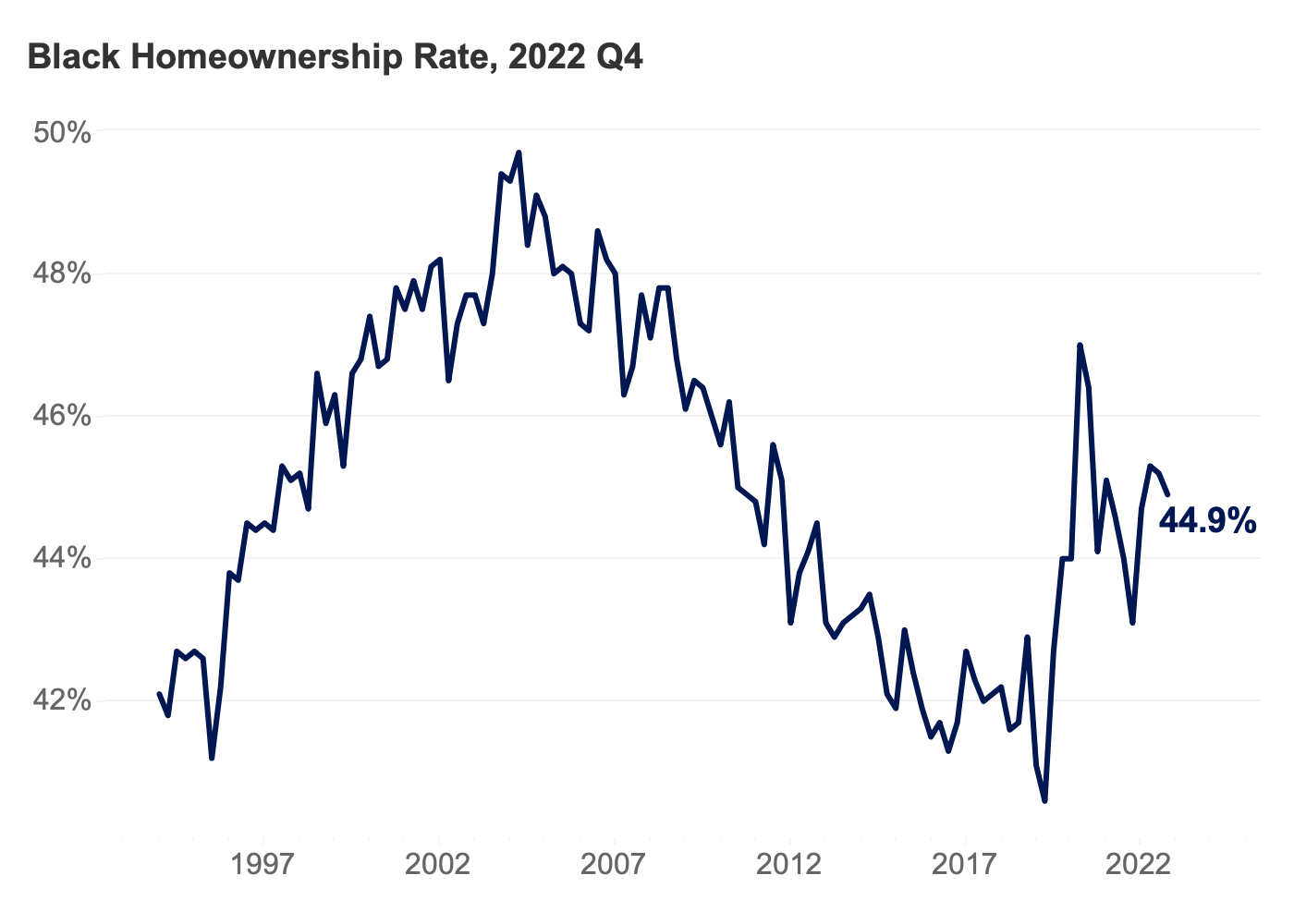

Black homeownership levels have long been struggling to rebound to the peak value seen pre-Great Recession – 2019 marked the first time since the peak Black homeownership rate in 2004 that there was a significant increase in Black homeownership nationally, then we entered into the pandemic that rocked the housing market and sent Black homeownership rates swaying.

But, based on the most recent Census data, homeownership for certain Black populations made big waves. Black women aged 75 and up and Black women aged 45-54 saw the largest increase in homeownership out of all Black age and sex homeowner groups during the pandemic — 2.9 percentage points of growth between 2019 and 2021 — followed by Black men aged 35-44, up 2.5 percentage points over that period. Other research suggests that younger, high income Black households took advantage of the low rate environment in 2020-2021 to achieve higher homeownership rates as well.

The improvement in Black homeownership rates over the pandemic is positively correlated with an increase in the ratio of Black home values to home values overall. Black homeowners in areas with a growing Black homeownership rate are more likely to have seen their equity surge over the past three years – a positive outcome for both these homeowners and these communities.

But that doesn’t mean barriers to accessing homeownership are no longer present. Many markets with the highest appreciation in Black home values have the highest mortgage denial rates for Black mortgage applicants. This means the markets where Black homeowners have had the best success improving their household wealth and approaching equal footing with homeowners overall are also the markets where those trying to break into homeownership have the most trouble securing the necessary financing.

Access to traditional financial services — which are underserved in many communities of color — can help to close the credit access gap and thus reduce the higher rate of mortgage denials that Black mortgage applicants endure, ultimately helping to reduce the racial homeownership gap. Resources like down payment assistance can help to remove the hurdle of a down payment to make homeownership more accessible. Through a partnership with Down Payment Resource , information on available down payment assistance programs can be found on home listings nationwide on the Zillow app and website.

This progress in improving Black homeownership and household wealth is long overdue, yet there is so much work left to be done. It’s imperative that progress continues to be made to ensure that future shocks to the housing market don’t knock back the forward momentum picking up steam now.

[1] From 2021 Home Mortgage Disclosure Act data.